The Pre-Roll Revolution: Driving Cannabis Industry Growth in 2024 and Beyond

By Harrison Bard, Co-Founder and CEO of Custom Cones USA & DaySavers

The cannabis industry continues to evolve at a rapid pace. Once considered an afterthought, pre-rolls have emerged as a dominant force in the market and the fastest growing segment of the cannabis economy and are on their way to generating $5 billion in revenue by 2030.

Custom Cones USA’s latest whitepaper, produced using data from cannabis analytics firm Headset along with surveys of pre-roll manufacturers, revealed some compelling insights into the state of the pre-roll market in 2024, including a new top pre-roll category and the unlimited potential it has for the future.

A $4 Billion Powerhouse

The numbers speak for themselves: pre-rolls generated $4.1 billion in revenue from January 2023 to June 2024, with over 394 million units sold. From June 2023 to June 2024, pre-rolls were the third-highest revenue generating category in the industry, behind only flower and vape pens.

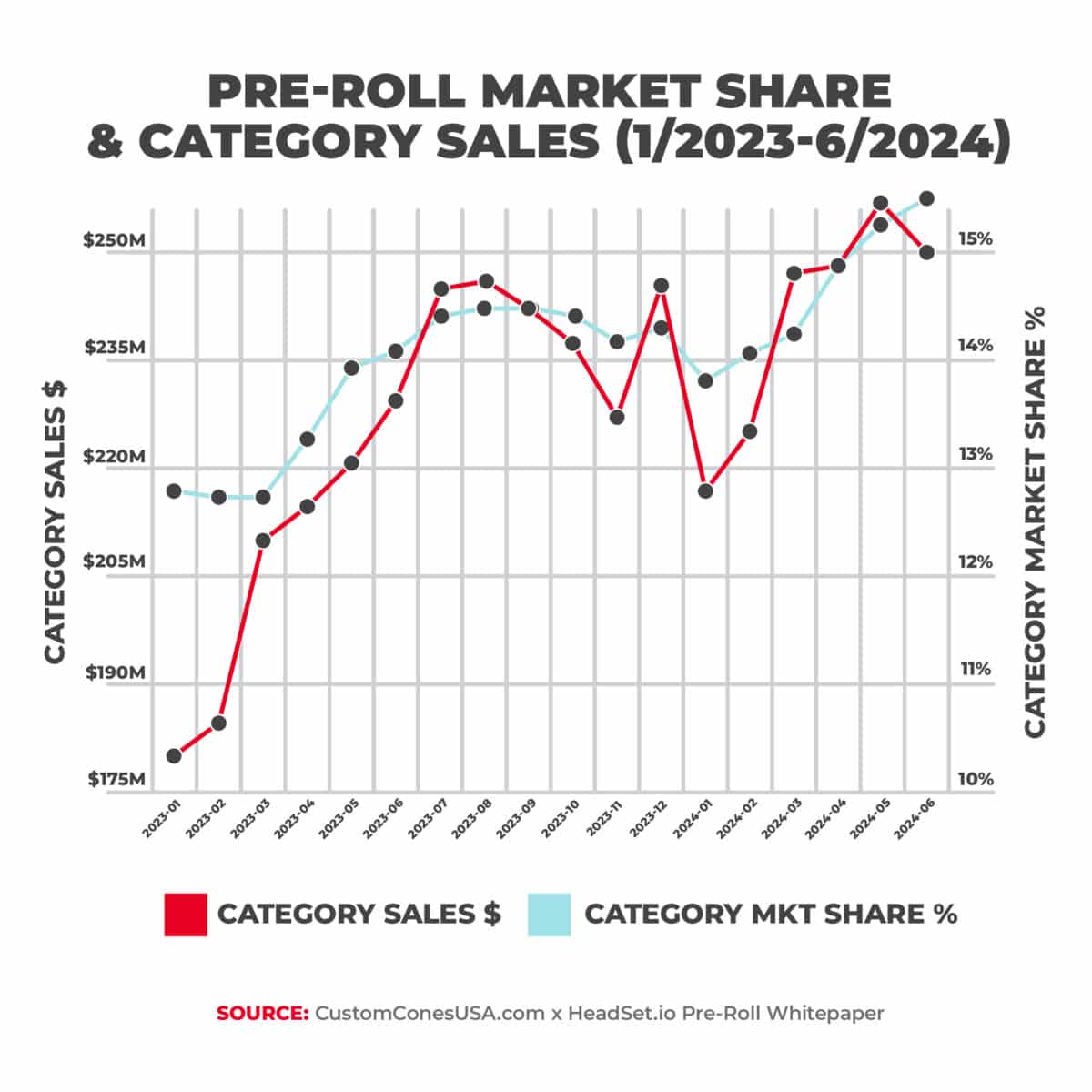

This remarkable growth is reflected in the increasing market share, which rose from 13.2% in January 2023 to a record-high 15.9% by June 2024. Monthly sales have seen a corresponding surge, climbing from $181.2 million to $257 million during the same period. That’s a year-over-year growth of 11.89%, the highest of any category in the industry.

This growth trajectory is even more impressive when we look back to 2019, when annual pre-roll sales revenue stood at just $469 million. In just five years, we’ve witnessed a nearly sixfold increase, reaching $2.7 billion in 2023.

The Rise of Infused Pre-Rolls

One of the most significant trends we’ve observed is the dominance of infused pre-rolls, which combine flower with a cannabis concentrate. In 2023, the Connoisseur/Infused category became the top-selling segment in the pre-roll market, overtaking Hybrid – Single Strain products. Infused pre-rolls alone accounted for more than $1.75 billion in sales from 2023 to mid-2024, commanding a 44.4% market share in the first half of 2024.

This shift towards infused products reflects changing consumer preferences, maturing markets and advancements in pre-roll machinery. The growing demand for potent, premium experiences has driven innovation in infusion technology, allowing producers to create high-quality products at scale while maintaining profitability.

The Multi-Pack Revolution

Another game-changing trend in the pre-roll market is the rise of multi-packs.

In 2018, multi-packs made up just 27.7% of the market. By June 2024, this figure had skyrocketed to 49.6%. Multi-pack sales revenue has seen a corresponding increase, jumping from $89.1 million in January 2023 to $127.4 million in June 2024 – a 43% increase in just 18 months.

The popularity of multi-packs is driven by their economic benefits for both producers and consumers. For manufacturers, multi-packs offer savings on packaging and labor costs. For consumers, they provide value and convenience, reducing the need for frequent dispensary visits.

The data shows that the 2.5-gram pack (five 0.5-gram pre-rolls) has emerged as the most popular multi-pack size, representing 16.2% of total pre-roll sales from January 2023 to June 2024. Of the products sold in all markets during those 18 months, 31 of the top 50 sellers were 5-pack pre-roll multipacks.

That said, single 1-gram pre-rolls still reign supreme, accounting for 42.3% of all pre-roll sales during this period

Price Dynamics and Market Maturation

Interestingly, while premium pre-roll sales – and their higher price point – are soaring, there’s a general trend of price stabilization and even slight declines across the broader pre-roll category. The average price of a pre-roll at dispensaries has fallen by 16.7% since January 2023, from $7.80 to $6.50 in June 2024.

This pricing trend is consistent across all segments, including the premium Connoisseur/Infused category. The average Connoisseur/Infused item price decreased by over 23% from January 2023 to June 2024, dropping from $11.51 to $8.77.

Despite this price decline, the pre-roll market remains highly profitable. The improved market share, skyrocketing unit sales (from 15.9 million items in January 2023 to 26 million in June 2024) and the rise of cost-effective multi-packs all contribute to maintaining strong margins for pre-roll businesses.

Looking Ahead: A Bright Future for Pre-Rolls

As we look to the future, all indicators point to continued growth and innovation in the pre-roll market. Several factors support our optimistic projections:

- Ongoing product innovation, particularly in the infused and multi-pack categories;

- Increasing consumer acceptance and demand for convenient, ready-to-use products, including pre rolled blunts;

- The introduction of pre-rolls to new markets, such as Ohio and Hawaii, as well as the opening of new markets in general;

- Potential federal rescheduling, which could open up new markets and demographics; and

- Continued price stabilization, making pre-rolls more accessible to a broader consumer base.

Based on current trends, we predict that pre-rolls are on track to become the largest product segment in the cannabis industry by 2030. They have already overtaken flower as the top category in Canada, for example. And the category’s ability to adapt to consumer preferences with different size and paper choices, coupled with its convenience and affordability, positions it for continued success in the States as well.

As new markets open and existing ones mature, we expect to see further innovations in product formulations, packaging, and production techniques. The rise of eco-friendly packaging options and the potential for new infusion methods could also reshape the market in exciting ways.

The pre-roll revolution is more than just a trend; it’s a fundamental shift in how consumers interact with cannabis products. As pre-rolls continue to gain market share, innovate in product offerings and adapt to consumer preferences, they’re not just participating in the cannabis industry’s growth – they’re driving it.

For industry professionals and consumers alike, the future of pre-rolls looks brighter than ever.

BIO:

Harrison Bard

Harrison Bard is the Co-Founder and CEO of Custom Cones USA and DaySavers. The Pre-Roll Experts at Custom Cones USA have a wealth of knowledge that extends into every sector of the pre-roll industry. From custom-branded and wholesale pre-rolled cones to completely customized packaging projects and pre-roll machines, we offer specialized expertise that will help bring your next pre-roll project to life. If you have a question about pre-rolls, Custom Cones USA has the answer.