State-by-State Breakdown: The Intriguing Dynamics of 4/20 Pre-Roll Sales

As the cannabis industry reflects on another 4/20 celebration, it’s clear that the holiday provides a big sales boost across markets. While this 4/20 was anything but record breaking – a comprehensive analysis by data firm Headset revealed that overall cannabis sales slightly dipped from last 4/20 – the pre-roll segment exhibited some of the strongest sales among cannabis categories.

Let’s take a closer look at the data to see how pre-roll sales fared in different markets and where they overperformed and underperformed.

Overview of National Sales

Nationally, the cannabis holiday generated $83.6 million in sales on 4/20, with over 6 million cannabis products sold across the U.S. and Canada. Despite a small year-over-year decline, these numbers affirm substantial consumer engagement during this period.

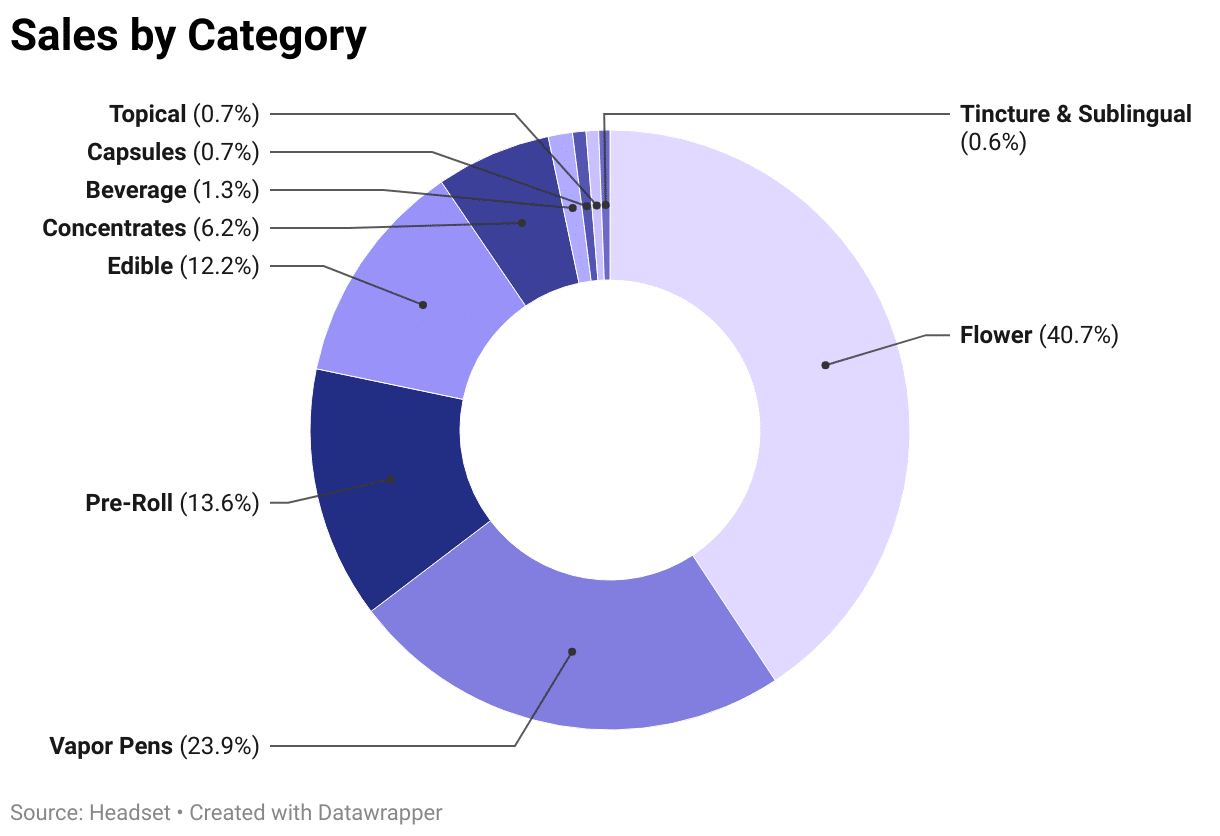

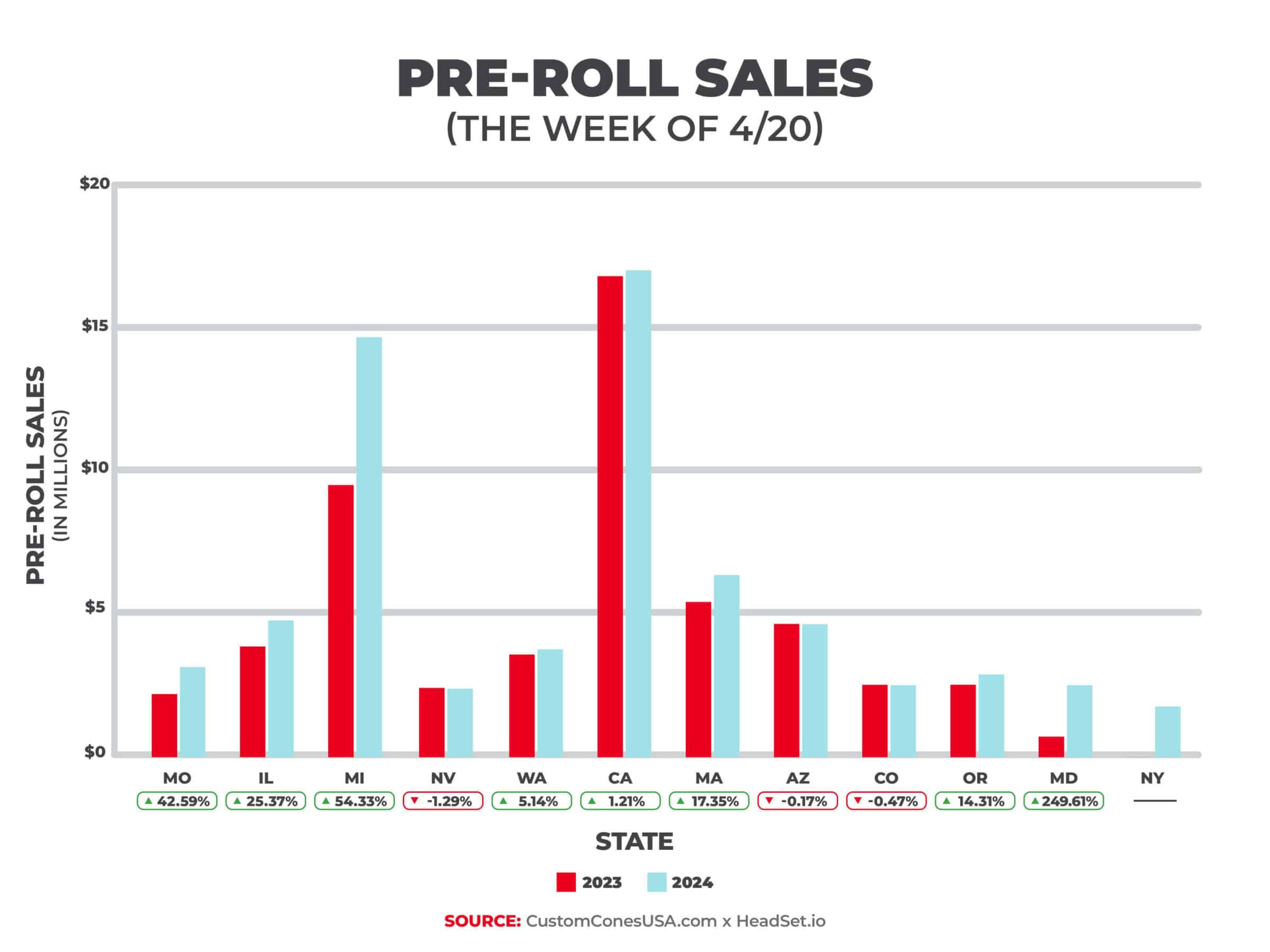

Particularly noteworthy is the performance of the pre-roll category, which not only resisted the downtrend but soared past previous years’ figures. Custom Cones USA’s analysis of 4/20 data showed that total pre-roll sales for the week of 4/20 hit $63.9 million, up from $52.2 million last year. Nearly 7 million pre-roll units including pre-rolled cones and pre-rolled tubes were sold during the week of 4/20, up from 4.9 million last year. The strong sales helped pre-rolls reach the third highest selling category on 4/20, behind flower and vapor pens.

Michigan: The Pre-Roll Powerhouse

Among the states, Michigan emerged as the champion of pre-roll sales. This state saw a staggering 54% increase in revenue compared to last year, with pre-roll sales topping $14 million. This is particularly impressive given Michigan’s population is significantly smaller than that of California, which led the sales at $16 million.

In Michigan, over 2.3 million pre-rolls were sold, more than doubling the previous year’s figures. Such robust growth highlights Michigan’s thriving market and the successful alignment of product offerings with consumer demand.

A Tale of Two Markets: California & New York

California, while leading in absolute numbers, showed a more modest increase relative to its size. The state’s $16 million in pre-roll sales underscores its massive market capacity. However, the growth rate in California suggests that even in well-established markets, there are significant opportunities to innovate and capture consumer interest more effectively.

Conversely, New York struggled, showing the lowest total pre-roll sales among the tracked states. This underscores the ongoing challenges in the rollout of its cannabis program but also highlights significant growth potential as the market infrastructure improves.

Underperformers: Arizona, Colorado, and Nevada

Contrasting sharply with the success stories are Arizona, Colorado, and Nevada. These states experienced a slight downturn in year-over-year pre-roll sales during the 4/20 week.

Despite an increase in total units sold in Arizona and Colorado, the revenue did not correspondingly increase, indicating a significant impact of pricing discounts on sales revenue. Nevada saw both a revenue decrease and a drop in total units sold, making it one of the few states with a notable decline in both metrics.

Pricing and Market Dynamics

The fluctuations in pre-roll pricing played a crucial role in shaping sales outcomes. For instance, Arizona witnessed a 12% increase in the average pre-roll item price, contrasting with price reductions in other states. This could be attributed to the higher cost of premium or infused pre-rolls, which continue to attract a dedicated consumer base despite higher prices.

Across the board, the average price of pre-rolls during the 4/20 week fell to $11.63, down 5.5% from the previous month. This reduction reflects strategic discounting intended to capitalize on increased consumer foot traffic and interest during the holiday.

Looking Ahead: What 4/20 Trends Tell Us

The varied state-by-state performance during this year’s 4/20 underscores the complex interplay of market maturity and pricing strategies in the cannabis industry. They also suggest that consumers are turning to pre-rolled cones and tubes thanks to the convenience and accessibility of these products.

While states like Michigan show what is possible with the right market conditions and consumer engagement strategies, the struggles in Arizona, Colorado, and Nevada remind us of the ongoing challenges in even established markets.

For a deeper dive into the detailed sales data and to understand more about the specific dynamics in each state, visit the comprehensive blog post from Custom Cones USA here.